The inflation rate reached a record high of 4.9 percent in November 2021 in the nineteen Eurozone countries, the highest since the European statistics institute Eurostat began its estimates more than two decades ago.

A year ago, the annual inflation rate in the EU was 0.3%. In January, inflation rose to 0.9%, then to 2% in May and 4.1% in October, compared with 3.4% the previous month, Eurostat, the European statistics office, said Wednesday.

But what exactly are we talking about? Inflation is defined by the European Central Bank (ECB) as an overall increase in the prices of goods and services, and not of a few specific sectors. It has many causes: the most common are a surge in demand that cannot be fully absorbed by supply and an increase in production costs – for example, raw material prices – that companies pass on to consumers. Consumers are the ones who suffer the most. Because higher prices mean lower purchasing power. In the end, one euro buys fewer goods or services.

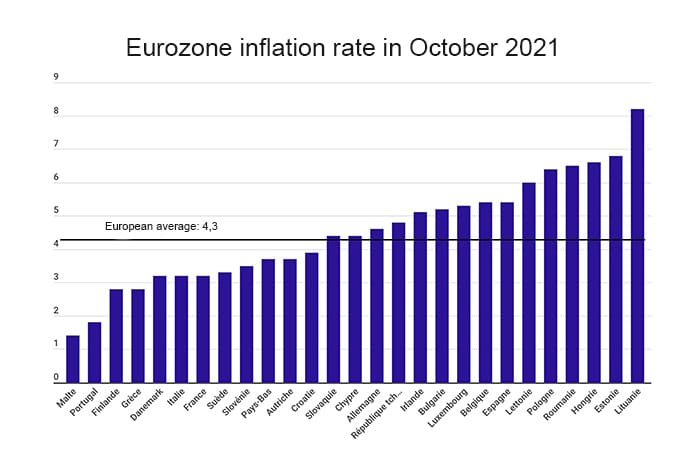

The lowest annual rates in October were recorded in Malta (1.4 percent), Portugal (1.8 percent), and Finland and Greece (both 2.8 percent). The highest were in Lithuania (8.2 percent), Estonia (6.8 percent), and Hungary (6.6 percent). Inflation rose in all 27 member states compared to September, Eurostat said.

As one might expect, energy has the greatest impact on this rise in inflation (+2.21%). Next came services (+0.86%), industrial goods excluding energy (+0.55%) and food, alcohol and tobacco (+0.43%).

The European Commission expects price increases to slow to 2.2% next year after “peaking” at 2.4% this year, according to a statement.

“The improvement in the labor market and an expected decline in household savings should help support household spending,” the Commission said.

It also expects the EU’s recovery plan, which resulted in initial payments to member states this summer, to support public and private investment.

Nevertheless, the European executive recognizes that the context is clouded by disruptions in global supply chains that “weigh on activity, particularly in the manufacturing sector.

According to ECB President Christine Lagarde, this price increase is only temporary. “Inflation will slow more slowly than previously anticipated, but we expect these factors to fade in 2022. We continue to expect inflation over the medium term to remain below our 2% target.”

Will price increases actually decelerate next year?

The majority of economists are leaning toward a lull, but others are of the opposite opinion. Investors also seem to be on the defensive, with many seeking protection from out-of-control inflation.

In early December, Jerome Powell, the head of the U.S. central bank (Fed), said it was time to stop talking about temporary inflation in the U.S., as he had been presenting it for months. “Clearly, the risk of persistent inflation has increased,” he acknowledged before a Senate committee.

The room for maneuver for central banks remains small. If commodity prices continue to rise, central bank actions will not reverse the trend. Raising interest rates will not solve the imbalances between supply and demand, soaring transportation costs or labor shortages that have been disrupting supply chains for several months.